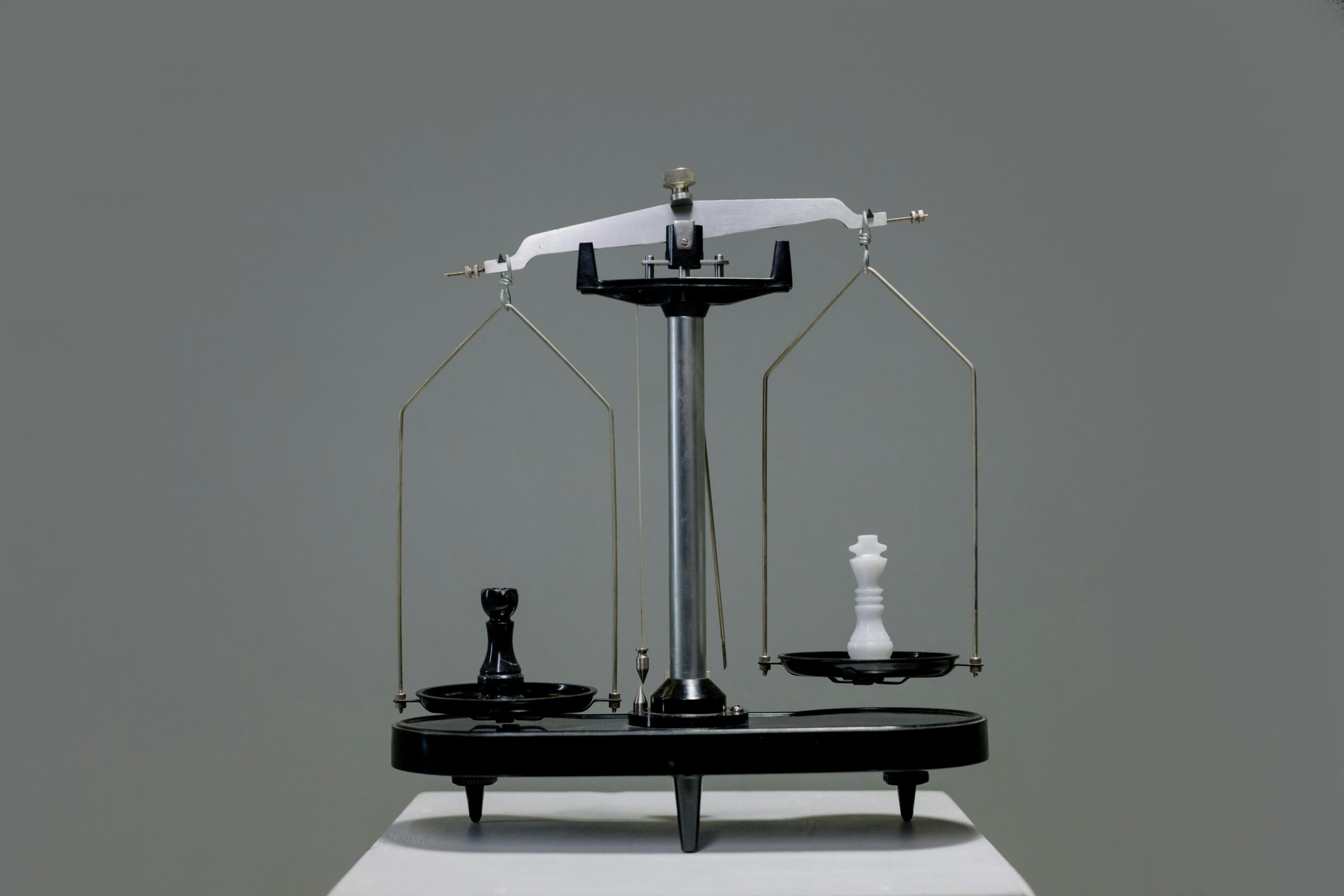

Every decision we make involves navigating the delicate balance between two critical types of errors: false positives and false negatives. Understanding this dynamic is essential for better outcomes.

🎯 Understanding the Foundation: What Are False Positives and False Negatives?

Before we can master decision-making, we need to establish a clear understanding of these fundamental concepts. False positives occur when we incorrectly identify something as true when it’s actually false—like a spam filter catching legitimate emails. False negatives happen when we fail to detect something that is actually true—like missing a fraud transaction that slips through undetected.

These concepts originated in statistical hypothesis testing but have expanded far beyond their mathematical roots. Today, they influence medical diagnoses, business strategies, security protocols, hiring decisions, and countless everyday choices. The key insight is that reducing one type of error often increases the other, creating an inherent tension in decision-making.

Consider a security checkpoint at an airport. If screeners are extremely cautious and flag every possible threat, they’ll catch more dangerous items (fewer false negatives) but will also stop many innocent passengers for additional screening (more false positives). Conversely, if they’re too lenient to avoid inconveniencing travelers, dangerous items might pass through undetected.

💼 The Business Implications: Where Money Meets Mistakes

In the business world, the cost of false positives and false negatives can be measured in dollars, reputation, and opportunity. Companies must constantly evaluate which type of error is more tolerable given their specific context and objectives.

Take credit card fraud detection as an example. Banks face a constant dilemma: they can implement strict fraud detection algorithms that block many legitimate transactions (false positives), frustrating customers and potentially losing sales, or they can use more lenient systems that allow some fraudulent charges through (false negatives), costing them money directly.

Research shows that false positives in fraud detection can lead to customer dissatisfaction and abandoned purchases, with some studies indicating that up to 15% of legitimate transactions are incorrectly declined. Yet the average fraud rate is typically below 0.1% of all transactions. This means companies are often rejecting legitimate business to catch relatively rare fraud cases.

The Hiring Paradox

Recruitment presents another fascinating case study. A false positive in hiring means bringing on someone who doesn’t perform well—a costly mistake involving salary, training, lost productivity, and potential severance. A false negative means rejecting a candidate who would have been excellent—an invisible opportunity cost that companies rarely track but can be equally damaging.

Most organizations are biased toward avoiding false positives in hiring, implementing lengthy interview processes, multiple rounds of assessments, and strict requirements. However, this conservative approach means they likely pass on many qualified candidates who could have contributed significantly. The best performers aren’t always the ones who interview perfectly or check every box on paper.

🏥 Medical Decision-Making: When Lives Hang in the Balance

Healthcare provides perhaps the most consequential arena for understanding false positives and false negatives. Medical testing and diagnosis require physicians to constantly weigh these competing risks, often with life-or-death implications.

Consider cancer screening programs. A false positive means telling a patient they might have cancer when they don’t, leading to anxiety, additional invasive testing, and potentially unnecessary treatments with serious side effects. A false negative means missing an actual cancer, allowing it to progress untreated when early intervention could have been life-saving.

Mammography screening illustrates this tension perfectly. Studies have shown that among women who get annual mammograms for a decade, approximately 50-60% will experience at least one false positive result. These false alarms lead to unnecessary biopsies, stress, and healthcare costs. However, screening also catches cancers early, saving thousands of lives annually.

The Sensitivity and Specificity Trade-off

Medical tests are evaluated using two key metrics: sensitivity (ability to correctly identify those with the condition) and specificity (ability to correctly identify those without it). A highly sensitive test minimizes false negatives but typically increases false positives. A highly specific test minimizes false positives but may miss some true cases.

Physicians must choose appropriate tests and thresholds based on the clinical context. For a rapidly progressing, life-threatening condition where treatment is relatively safe, they’ll favor sensitive tests to avoid missing cases. For conditions where the treatment itself carries significant risks, they’ll prefer specific tests to avoid unnecessary interventions.

⚖️ Finding Your Personal Balance: Context Is Everything

The optimal balance between false positives and false negatives isn’t universal—it depends entirely on context, consequences, and values. Developing decision-making mastery requires understanding when to be cautious and when to be bold.

Start by asking yourself these critical questions for any significant decision:

- What are the actual costs of each type of error in this specific situation?

- Which type of error is irreversible or harder to correct later?

- What are the opportunity costs of being too conservative or too aggressive?

- How does uncertainty factor into the equation?

- What are my natural biases, and how might they skew my judgment?

Consider investment decisions. Value investors like Warren Buffett deliberately accept more false negatives (passing on investments that would have succeeded) to minimize false positives (investing in companies that fail). This conservative approach has proven successful over decades, but it means missing out on many opportunities. Growth investors take the opposite approach, accepting more failures to capture high-potential opportunities.

🧠 Cognitive Biases: The Hidden Forces Shaping Your Decisions

Our brains aren’t naturally calibrated to make optimal decisions about false positives and false negatives. Evolutionary pressures shaped our decision-making systems in environments very different from today’s world, leaving us with systematic biases that can lead us astray.

Loss aversion is one of the most powerful biases affecting this balance. Research shows that people feel losses roughly twice as intensely as equivalent gains. This means we’re naturally inclined to avoid false positives (actions that lead to losses) more than we avoid false negatives (inaction that leads to missed opportunities).

The availability heuristic also skews our judgment. We overweight recent, vivid, or emotionally charged examples when assessing risks. If you recently heard about someone who was scammed online, you might become overly cautious in legitimate online transactions, increasing your false positive rate. Conversely, if you haven’t personally experienced identity theft, you might underestimate the risk and fail to take appropriate precautions.

Status Quo Bias and Decision Paralysis

Many people exhibit a strong preference for the status quo, which effectively means favoring false negatives over false positives. Doing nothing feels safer than taking action, even when inaction carries significant costs. This bias explains why people stay in unfulfilling jobs, maintain underperforming investments, or remain in unhealthy relationships.

The irony is that inaction is itself a decision with consequences. By avoiding the potential false positive of making a change that doesn’t work out, we guarantee the false negative of missing opportunities for improvement.

📊 Data-Driven Approaches: Using Metrics to Calibrate Decisions

While intuition plays a role in decision-making, systematic measurement and analysis can dramatically improve your ability to strike the right balance. Organizations that track their decision outcomes can identify patterns and adjust their thresholds accordingly.

One powerful tool is the confusion matrix, a framework for visualizing the four possible outcomes of any binary decision: true positives, false positives, true negatives, and false negatives. By tracking your decisions over time and categorizing outcomes, you can calculate your actual error rates and compare them to your tolerance thresholds.

For example, if you’re managing a content moderation system, you might track how many posts you remove (actions taken) versus allow (no action). Among removed posts, how many were genuinely problematic (true positives) versus wrongly censored (false positives)? Among allowed posts, how many were appropriate (true negatives) versus should have been removed (false negatives)?

ROC Curves and Threshold Optimization

More sophisticated decision-makers use Receiver Operating Characteristic (ROC) curves to visualize trade-offs across different decision thresholds. These graphs plot true positive rate against false positive rate, helping identify the optimal operating point for your specific needs.

The beauty of ROC analysis is that it makes the trade-off explicit and quantifiable. You can calculate the costs of different error types and find the threshold that minimizes total expected cost. This transforms decision-making from art to science, though human judgment remains essential in defining costs and values.

🔄 Adaptive Decision-Making: Learning From Your Errors

Perhaps the most important skill in mastering decision-making is developing the ability to learn from both types of errors and adjust your approach over time. This requires tracking outcomes, being honest about mistakes, and maintaining the flexibility to update your decision criteria.

Create a decision journal where you record significant choices, your reasoning, the threshold you applied, and eventual outcomes. Over time, patterns will emerge. You might discover you’re consistently too conservative in certain domains and too aggressive in others. This self-awareness enables targeted improvement.

Pay special attention to false negatives, which are often invisible. It’s easy to notice when you make a bad hire (false positive), but much harder to recognize all the great candidates you passed on. Periodically review rejected options to see how they turned out. Did that job candidate you didn’t hire become successful elsewhere? Did that business opportunity you declined work out for someone else?

🎭 Industry-Specific Strategies: Tailoring Your Approach

Different fields have developed specialized approaches to managing the false positive/false negative balance based on their unique constraints and consequences.

In criminal justice, the principle that it’s “better for ten guilty persons to escape than for one innocent to suffer” reflects a strong bias toward avoiding false positives (wrongful convictions). This philosophical stance shapes everything from burden of proof standards to jury instructions.

Software development has embraced “fail fast” philosophies in many contexts, accepting more false positives (flagging potential bugs that aren’t actually problems) to avoid false negatives (shipping code with undetected issues). Automated testing suites are deliberately calibrated to be oversensitive, knowing that humans can quickly dismiss false alarms but might not catch real problems.

Emergency medicine operates under time pressure with incomplete information, leading to different calibrations than research medicine. Emergency physicians are trained to “rule out the worst first,” accepting higher false positive rates for serious conditions because missing a heart attack or stroke (false negative) could be fatal, while over-testing carries more acceptable costs.

💡 Practical Frameworks for Everyday Decisions

You don’t need advanced statistics to apply these principles in daily life. Here are practical frameworks anyone can use to improve their decision-making balance:

The Regret Minimization Framework: When facing a decision, imagine yourself in the future looking back. Which type of error would you regret more? This helps overcome present bias and clarify your values.

The Reversibility Test: Ask whether the decision can be easily reversed or corrected. For reversible decisions, favor action (accept more false positives) since mistakes can be fixed. For irreversible decisions, be more cautious (avoid false positives).

The Expected Value Calculation: Estimate the probability and cost of each outcome type. Multiply them to get expected values and choose the option with the best expected outcome. This makes implicit trade-offs explicit.

The Two-Way Door Principle: Amazon founder Jeff Bezos categorizes decisions as one-way doors (hard to reverse) or two-way doors (easy to reverse). Use rigorous processes for one-way doors but move quickly through two-way doors, accepting higher error rates knowing you can backtrack.

🌟 Cultivating Wisdom: Beyond Algorithms and Frameworks

While data and frameworks are valuable, true mastery requires developing wisdom—the ability to apply the right framework at the right time and recognize when to trust intuition over analysis.

Wisdom comes from experience, reflection, and humility. It means recognizing that you’ll never eliminate errors completely and that perfection isn’t the goal. The goal is making better decisions over time, learning from mistakes, and maintaining the courage to act despite uncertainty.

Great decision-makers develop what might be called “error wisdom”—an intuitive sense for when to be cautious and when to be bold, calibrated through years of experience in their domain. They know that the optimal balance shifts with context, stakes, and available information.

They also understand that different life domains require different calibrations. You might appropriately be very conservative with health decisions (favoring false positives when symptoms appear) while being more aggressive with career risks (accepting false positives by trying opportunities that might not work out).

🚀 Moving Forward: Your Decision-Making Evolution

Mastering the balance between false positives and false negatives is a lifelong journey, not a destination. As you encounter new situations, develop new capabilities, and face different constraints, your optimal balance will shift. The key is maintaining awareness of this dynamic and consciously choosing your approach rather than defaulting to unconscious biases.

Start by identifying one important area of your life where decisions matter. Track your choices and outcomes for a month. Are you being too conservative or too aggressive? Are your errors clustered in one type? Use this information to make small adjustments and observe the results.

Remember that the perfect balance doesn’t mean zero errors—it means the right mix of errors for your goals and values. Accept that you’ll make mistakes of both types, but ensure they’re mistakes you can live with and learn from. This acceptance paradoxically improves decision-making by reducing the paralysis that comes from seeking impossible perfection.

The art of decision-making lies not in eliminating uncertainty but in dancing with it skillfully. By understanding the false positive and false negative trade-off, you gain a powerful lens for analyzing choices and a practical tool for improving outcomes. Whether you’re leading an organization, managing your career, protecting your health, or navigating relationships, this framework provides clarity in complexity and confidence in uncertainty.

Toni Santos is a financial researcher and corporate transparency analyst specializing in the study of fraudulent disclosure systems, asymmetric information practices, and the signaling mechanisms embedded in regulatory compliance. Through an interdisciplinary and evidence-focused lens, Toni investigates how organizations have encoded deception, risk, and opacity into financial markets — across industries, transactions, and regulatory frameworks. His work is grounded in a fascination with fraud not only as misconduct, but as carriers of hidden patterns. From fraudulent reporting schemes to market distortions and asymmetric disclosure gaps, Toni uncovers the analytical and empirical tools through which researchers preserved their understanding of corporate information imbalances. With a background in financial transparency and regulatory compliance history, Toni blends quantitative analysis with archival research to reveal how signals were used to shape credibility, transmit warnings, and encode enforcement timelines. As the creative mind behind ylorexan, Toni curates prevalence taxonomies, transition period studies, and signaling interpretations that revive the deep analytical ties between fraud, asymmetry, and compliance evolution. His work is a tribute to: The empirical foundation of Fraud Prevalence Studies and Research The strategic dynamics of Information Asymmetry and Market Opacity The communicative function of Market Signaling and Credibility The temporal architecture of Regulatory Transition and Compliance Phases Whether you're a compliance historian, fraud researcher, or curious investigator of hidden market mechanisms, Toni invites you to explore the analytical roots of financial transparency — one disclosure, one signal, one transition at a time.